- Alternative Data

Using News Sentiment in Investment Decisions

Investors and companies have always aspired to make investment decisions by using diverse information sources. The Nikkei Group handles a wide variety of raw data ranging from traditional financial data to alternative data such as news articles, access rankings, and POS data. At Nikkei FTRI, we convert the raw data into factor signals, and—through our SMACOM tool—provide more than 150 factors.

News has always had an impact on markets, and is obviously a key source of information for investors. But the vast amount of news published means it is impossible for investors to read it all. Using machine learning to extract sentiment from news has become a key part of the decision-making process.

Here we introduce our news sentiment factor based on the RoBERTa (Robustly Optimized BERT pre-training Approach) language model. The news sentiment factor uses machine learning such as natural language processing and neural networks to evaluate whether a news item released by Nikkei Group is positive, negative, or neutral. In our model, we created roughly 70,000 labelled data which evaluate each news item as positive, negative, or neutral. Of these, roughly 50,000 were used as training data for parameter estimation, and the remining 20,000 as test data to select the best model. Finally, in addition to the positive, negative, and neutral probabilities, we also generated a composite probability, which is a combination of the three. Our news sentiment factor demonstrates that it has a strong cross-sectional return predictive power.

First, we will take quick a look at the performance of the news sentiment factor. The investment universe composed of all the stocks that were mentioned in the news. The backtesting sample period was from December 30, 2019 to February 29, 2024. We assumed that were trading at closing prices (at 3:00 pm) with news sentiment factor as of 12:30 pm on the same day. The rebalancing frequency was daily, long-short strategy was long top 10% short bottom 10%, and transaction costs were not considered.

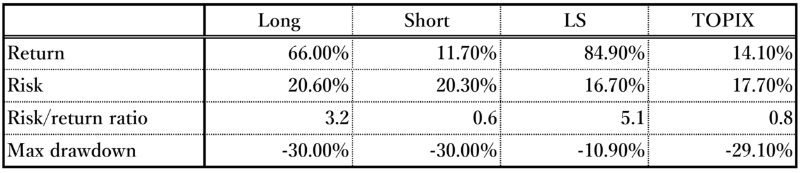

Table1 Performance of news sentiment factor

Table 1 shows the performance of the news sentiment factor based on the composite probability. The word "Long" indicates the strategy which long top 10%, "Short" indicates the strategy which short bottom 10%, "LS" indicates the long-short strategy which long top 10% and short bottom 10%, and "TOPIX" indicates the TOPIX (Tokyo Stock Exchange Stock Price Index), including dividends. In terms of "LS" strategy, annualized return is 81.4%, risk is 16.7%, risk-return ratio is 4.9, and maximum drawdown is -10.9%. The result demonstrates that news sentiment factor has a higher return, a lower risk and a higher risk-return ratio compared to TOPIX. We also confirmed rank correlations between news sentiment factor and major quant factors. We found that the correlations are almost zero, which can lead to a better diversification effect if incorporating news sentiment factor into a quant model.

Next, news sentiment analysis plays an important role in the prediction of stock price trends. The reason is that the stock market is heavily influenced by the news. Several previous studies have shown that sector-based grouping of news sentiment improved the performance of the stock price prediction. We aggregated the news sentiment to TSE17 industries (Tokyo Stock Exchange 17 classification Industry), and then we chose the top 3 sectors and bottom 3 sectors. Since the top sector contains more positive news and the bottom sector contains more negative news, we conducted the same backtesting by extracting more positive and negative news in the selected sectors for stock basis (Top-Down approach).

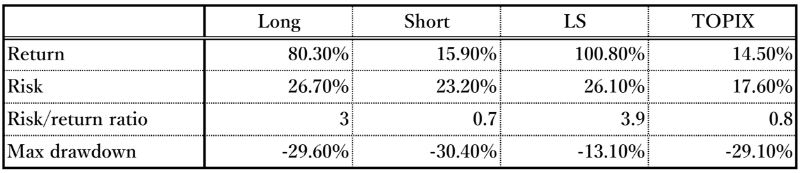

Table2 Performance of news sentiment factor based on selected sectors

The results suggest that this Top-Down approach (from sector to individual stocks) could obtain better performance than the all-stock approach as shown in Table 1.

In this article, we have introduced our news sentiment factor and Top-Down approach based on sectors. In recent years, many studies have used machine learning such as a Long-Short Term Memory in stock predictions. We will introduce machine learning based factors at a later date.

If you are interested in our services, please feel free to contact us.

https://www.ftri.co.jp/eng/index.html#company

Nikkei FTRI

Nikkei FTRI is a member of the Nikkei Group that works with data analysis technology. We are recognized for the high quality of our analytical and modeling techniques, which utilize both traditional and alternative varieties of data.

See More